When a property in the Philippines changes ownership, a transaction is invalid if the name on the title belongs to a dead owner. A transaction can only be consummated once the estate of the deceased has been settled.

Settlement of the estate does not only refer to change in ownership, it also means payment of any outstanding capital gains and estate taxes at the Bureau of Internal Revenue. In some cases, to avoid hassles and payment of arrears, sellers push through with the sale even if they are aware the owner has passed away already. But such short-term savings and convenience could hit a snag sooner or later so it’s always a good practice to do what is proper and ethical.

Extrajudicial settlement of estate can only be executed if the following conditions are satisfied:

1. The decedent left no will

2. The decedent has no debts or his debts have been fully paid.

3. The heirs are all of legal age or the minors are duly represented by their judicial or legal representatives.

4. A public instrument is duly executed by the heirs and filed with the Register of Deeds.

Otherwise, judicial proceedings is the likely route.

Here are the steps in accomplishing such procedure:

Step 1:

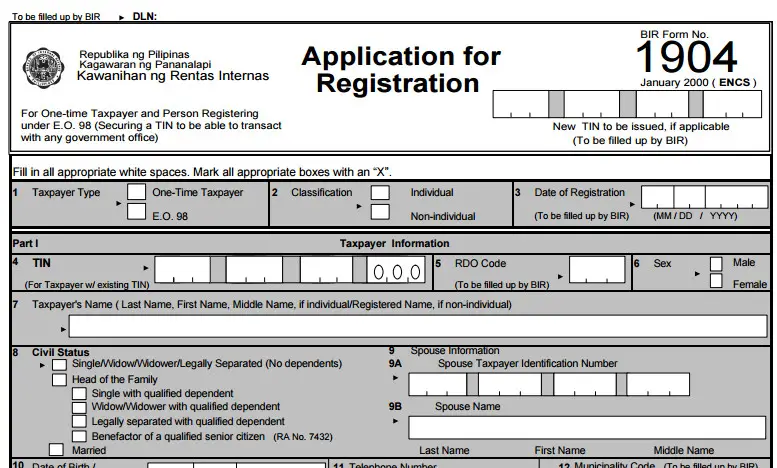

Fill out BIR Form 1904. This form is to be accomplished by one-time taxpayer and persons registering and applying for a TIN but in this case the estate of the deceased owner will have a separate TIN from heirs who intend to sell the property.

On the form:

- On the Taxpayer Type, mark with an “X” the box indicating “One-Time Taxpayer”

- On Classification, mark with an “X” the box indicating “Non-individual”

- On Sex, mark with an “X” the appropriate box indicating gender of the deceased.

- Write “ESTATE OF [deceased person’s name]” in the space provided for the Taxpayer’s Name.

- On the Civil Status, mark with an “X” the appropriate box indicating civil status of the deceased.

- On the Date of Birth, write the date of death of the decedent as it appears in the Certificate of Death.

- Write the Local Address of the decedent in the space provided for. This should match the information indicated in the death certificate. If the deceased died abroad and has no Philippine residence, fill out the Foreign Address indicated in the death certificate and filing of the Estate Tax

- Return should be made at the BIR Revenue District Office (RDO) No. 39 (South Quezon City) or the Philippine Embassy or Consulate where the deceased has died.

- Mark an “X” on the box indicating Transfer of Properties by Succession (Death).

- On Tax Types mark an “X” the box indicating Estate Tax.

Indicate the name of the Taxpayer/Authorized Agent and sign the same. Attach a photocopy of the certified copy of the Certificate of Death to Form 1904.

Step 2:

Prepare required documents. The following documents are required for submission to the BIR:

1. Notice of Death

2. Certified true copy of the Death Certificate

3. Deed of Extra-Judicial Settlement of the Estate

4. Certified true copy of the land titles involved

5. Certified true copy of the latest Tax Declaration of real properties at the time of death

6. Photo copy of Certificate of Registration of vehicles and other proofs showing their correct value

7. Photo copy of certificate of stocks

8. Proof of valuation of shares of stocks at the time of death

a. For listed stocks – newspaper clippings or certification from the Stock Exchange

b. For unlisted stocks – latest audited Financial Statement of issuing corporation with computation of book value per share

9. Proof of valuation of other types of personal property

10. CPA Statement on the itemized assets of the decedent, itemized deductions from gross estate and the amount due if the gross value of the estate exceeds two million pesos

11. Certification of Barangay Captain for claimed Family Home

Please check with BIR for updated checklist if the above is outdated.

Step 3:

Prepare Estate Tax Return (BIR Form 1801).

Fill up the name and the TIN of the Estate on the spaces provided in Form 1801.

Seek assistance of an officer of the day if you have questions in filling out the form, as well as the computation made on the review of documents submitted. However, if the estate of the deceased is more than P3 million then it would be wise to consult a certified public account to determine the initial computation of the taxable estate.

Step 4:

Pay the assessed estate tax as computed.

You may settle the estate tax with an Authorized Agent Bank of the Revenue District Office which has jurisdiction over the place of residence of the decedent at the time of his/her death. For smaller amount, it is often settled by cash. However, for larger amount and security is an issue, payment can also be made out to Manager’s or Cashier’s Check.

Should the payment be made at an Authorized Agent Bank, such as Landbank of the Philippines, the payee can be referred to as “Bureau o Internal Revenue.”

If payment is made through a Manager’s or Cashier’s Check, the following should be written as payee: “[BANK, BRANCH] FAO BUREAU OF INTERNAL REVENUE IFO [TAXPAYER’S NAME] [TIN OF TAXPAYER].”

Step 5:

Submit all requiremd documents and proof of payment to the Revenue District Office which has jurisdiction over the place of residence of the decedent. You will then be issued a claim stub with reference number you can refer to when you check if Certificate Authorizing Registration has already been issued.

Based on the evaluation of BIR, heirs may be asked to provide additional documents, especially pertaining to the deductions claimed by the estate. Processing takes at least 60 days.

Step 6:

Once the Certificate Authorizing Registration is released, the property can now be sold to a buyer. The Certificate Authorizing Registration, along with the transferring document – Extra-judicial Settlement of Estate, Affidavit of Self-Adjudication, etc. – and the Tax Clearance Certificate should be part of the documents to be presented when paying the capital gains and documentary stamp taxes covering the sale of the property.